Turning Data into Insights: Google Planning Tools

Google Trends and the Consumer Barometer

Think with Google offers a free suite of tools for advertisers to learn about consumer behaviour and how that translates to marketing messages and paid ads. With these free tools, PPC experts can gather information about their audience’s behaviour and apply what is learned in their paid campaigns. Below we have highlighted available tools and how to use them for paid campaigns.

Google Trends

With Google Trends, we can tap into intent when consumers are searching online and also learn how interests change over time and across geography which is important for regional campaigns. Data is refreshed weekly so it is up to date for those who want to explore very recent data.

To use it, PPC experts start by entering search terms to compare in Google Trends. From there, it is possible to drill into specific geographic areas and select a time period, such as the past year and also segment by images, news, shopping or YouTube.

Note that the results in Google Trends are based on search interest not searches. Search interest is that specific interest as a proportion of all searches for all topics on Google. Google Trends searches for your specific search phrase in a country for example, then divides that by all searches for that country. In other words, it is about the relative interest in a topic. With Google Trends, you can also see popular queries, related queries, and rising queries versus top queries.

With Google Trends, you can discover if interest in an area increases over time – whether that interest is your brand, a competitor, or a specific category. Drill in even further to see how interest in one of these areas has changed across countries.

This is also a helpful tool for small brick and mortar businesses who may not think a web presence is important. For example, if there are a number of local searches for a family dentist, a dental practice may realise they need to have an online presence since data shows that people are searching for that type of care online.

If some of the top queries or search interest terms are not in your AdWords account, consider adding them as keywords or incorporate them into content for your site. This tool can also help you discover negative keywords that can be added to your AdWords account so ads will not trigger for those terms. This tool will not show CPC bids, it is only for categories and trends over time. However, PPC experts can plug those terms into the AdWords keyword planner to get estimated costs. And keep in mind that a search terms are viewed differently in Google Trends (search interest) than they are on Google.com (search query).

Consumer Barometer

With the Consumer Barometer, PPC experts can learn how people use the internet for content, research, and shopping. This data sits on top of surveys conducted with consumers worldwide based on interviews with over 400,000 respondents across 56 countries and offers several buckets of data to explore.

The Online and Multiscreen World shares how consumers interact with brands, and includes data about how often and with which device they interact with the internet.

The Smart Shopper includes 20 product categories to see what products people search for in different markets. PPC experts can look back at previous holidays or seasons and see what was trending during that time. This tool also offers a heatmap with different products with the option to drill into further detail.

As video continues to grow, The Smart Viewer provides general viewing data to see how often people watch videos and their most recent sessions which tells where and why people watch. To learn more about using the Consumer Barometer, check out the short clip below.

https://www.youtube.com/watch?v=HZH6ZJyYB1A#action=share

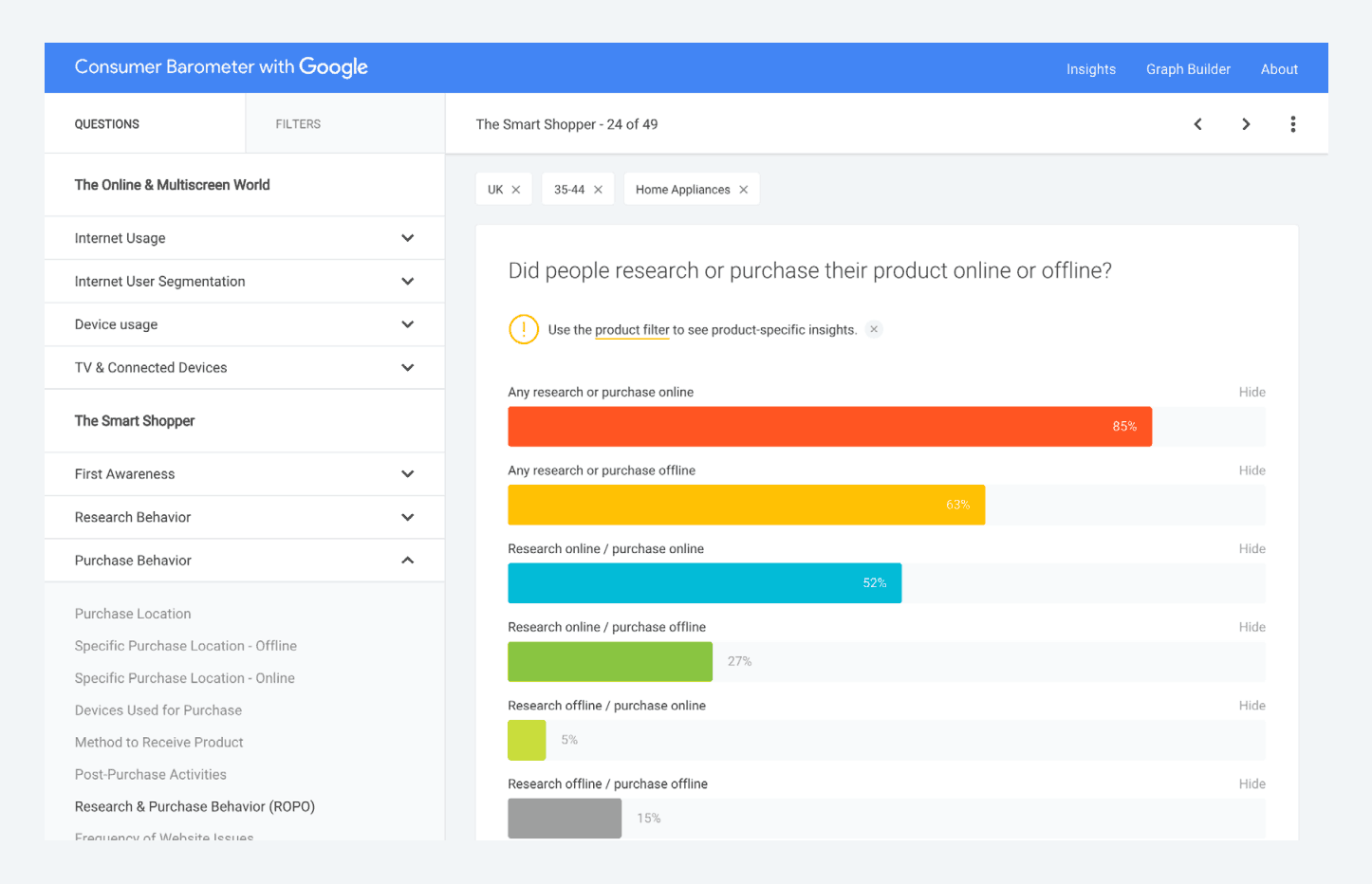

Consumer Barometer- Graph builder

The graph builder is part of the Consumer Barometer suite of tools. With it, PPC experts can filter by country, demographics, and internet use to answer specific questions. For example, one may want to know how many brands people considered before making a purchase in a specific category. By selecting smart shopper questions in the graph builder, and then drilling into a category for that product type, advertisers can see real world data that answers that question.

If the discovery is that consumers generally buy on the first visit for a specific product type, brands need a very strong presence so when the consumer is ready to buy, the brand comes to mind. If they take more time with their decision, a business may not see quite as many direct conversions on their websites since consumers are spending time on research across multiple channels and as a result, there are fewer direct conversions when people land on the site because there is a longer time period between first visit and purchase.

Overall, this tools offers a lot of data about research and purchase behaviour as well as how online and offline channels interact in the path to purchase. What devices are used for research is another question to ask because PPC ads can target the appropriate device at the right time in the consumer journey – and target based on demographics that are important.

Display Benchmarks Tool

Consumers will respond differently to display ads and advertisers want to know how this response translate to metrics, such as click-through rate. With the Display Benchmarks Tool, advertisers can view data by format, region, and trends, to understand how their display campaigns compare to the industry average.

To use this tool, select a country, vertical, ad size and image format, then get a snapshot report to see how click through rate changes over time. If clients are concerned that their clicks have dipped with display advertising, it can be helpful to show if this is trend happening in similar industries as well.

Shopping Insights

The Shopping Insights tool allows you to compare shopping patterns and trends across the United States to make better merchandising and promotions decisions. PPC experts can see which products have the most interest and where searches are increasing (or decreasing) over time. It also allows United States based advertisers to see mobile versus desktop shopping patterns. Using what is learned here can help maximize your Google Shopping Conversion Rates.

Google Surveys

Google Surveys offer an opportunity to directly ask questions of your website visitors or to a more general audience for the purpose of doing some market research. Advertisers can create a new survey within minutes and get a Google snippet to install on the website when the goal is to reach website visitors as a target group.

The second option is to reach target groups you normally do not have access to and gather data from audiences beyond those to your website. These audience panels are made up of groups of people who opted in to receive surveys. Either option offers consumer insights fast with segmented groups based on factors, such as gender or age.

With Google Trends, Shopping Insights, Display Benchmark Tools, and the Consumer Barometer, Google offers a wealth of data for free outside of the AdWords Keyword Tool. Learn how people talk about what you offer and discover the trends over time and place. Explore real-world data and public data from Google and strategically incorporate these findings into your next paid campaign. And as we discussed in our post about Google Marketing Next, we are looking forward to what else on the horizon for reaching consumers in each stage of their journey.